In todays fast-paced financial landscape, the stakes have never been higher. Investors and traders are constantly grappling with the challenge of navigating volatile markets, where the difference between a winning strategy and a crippling loss can hinge on minute decisions.

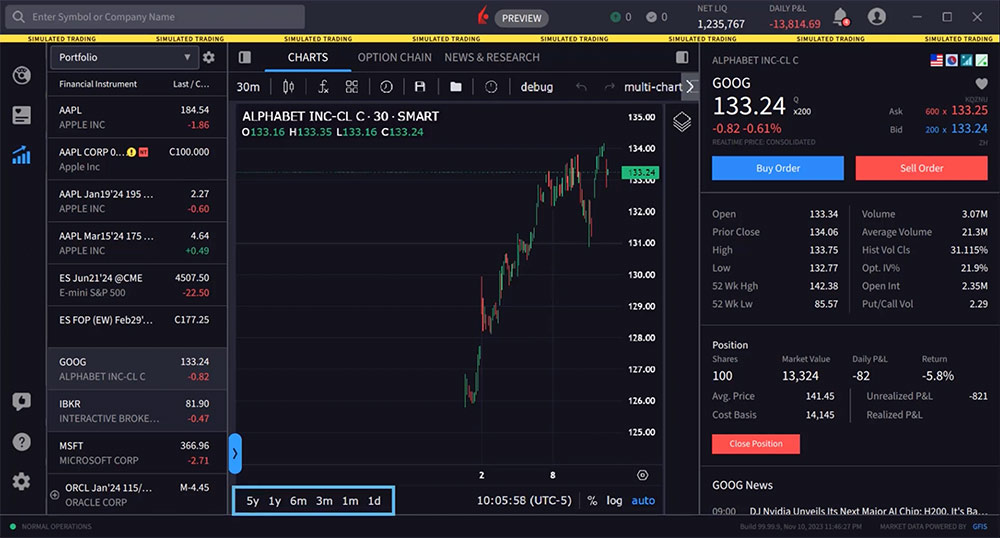

Enter simulated trading—a powerful tool that has the potential to reshape your entire approach to risk. Imagine stepping into a refined laboratory of economic behavior, where you can experiment freely, testing strategies without the fear of real-world consequences.

This innovative practice not only cultivates your decision-making skills under pressure but also sharpens your ability to anticipate and react to market movements. As we delve into the transformative effects of simulated trading, prepare to uncover a new realm of financial acumen that empowers you to embrace risk, adapt methodologies, and ultimately enhance your trading journey.

Introduction to Simulated Trading

Simulated trading, often referred to as paper trading, offers a unique gateway into the bustling world of financial markets without the immediate pressure of real money on the line. Imagine exploring intricate trading strategies, experimenting with diverse asset classes, and observing market behaviors—all from the safety of a virtual environment.

With tools like bar replay free tool, traders can step back in time to analyze past market movements, refining their strategies by replaying historical price action. This process not only fosters a deeper understanding of market dynamics but also allows traders to sharpen their decision-making skills.

The beauty of simulated trading lies in its power to illuminate risk management techniques; it encourages users to confront their assumptions and emotions, providing a playground for learning and growth. As you delve into this fascinating realm, you’ll find that each trade, each mistake, and each small victory can be a stepping stone toward a more informed and confident trading approach.

Whether you’re a novice eager to learn or an experienced trader seeking to refine your tactics, simulated trading can be a transformative journey, reshaping your outlook on risk in ways you may not have anticipated.

The Importance of Risk Management in Trading

Risk management is an essential cornerstone in the realm of trading, serving as the protective barrier between a trader’s ambition and the inevitable unpredictability of the markets. Without a robust strategy to identify, assess, and mitigate potential threats, traders can quickly find themselves ensnared in devastating losses that could undermine their entire financial portfolios.

Imagine navigating a turbulent sea without a compass—chaos reigns, and victories become fleeting. By implementing calculated risk management techniques, traders can cultivate a disciplined approach that not only safeguards their capital but also enhances their decision-making process.

This proactive stance enables one to embrace opportunities with confidence, turning the tide even in challenging market conditions. In a landscape where emotions can steer one astray, effective risk management transforms the chaos into a path of informed choices, fostering a sustainable trading practice where calculated risks yield rewards.

Enhancing Decision-Making Skills in a Risk-Free Environment

Simulated trading creates a unique opportunity for individuals to hone their decision-making skills without the repercussions of real-world consequences. In this controlled environment, participants can experiment with various strategies, tweaking their approach based on market fluctuations and personal insights.

Imagine grappling with high-stakes situations: a sudden market plunge or an unexpected surge—here, you can simulate these scenarios, assessing your reactions and choices with clarity. This practice fosters a deeper understanding of risk management, allowing traders to dissect their decisions and learn from missteps without losing capital.

The iterative nature of this process cultivates confidence, equipping individuals with the analytical tools necessary to navigate unpredictable markets successfully. Ultimately, it transforms the intimidating landscape of trading into a playground for learning, where every decision, right or wrong, propels you closer to mastery.

Conclusion

In conclusion, simulated trading offers a transformative approach to understanding and managing risk in financial markets. By providing a risk-free environment to practice strategies and refine decision-making skills, traders can develop a deeper comprehension of market dynamics without the pressure of real capital on the line.

Tools like the bar replay free tool further enhance this learning experience, allowing traders to revisit and analyze historical market data in a customizable manner. As a result, engaging with simulated trading not only cultivates confidence and discipline but also equips traders with the insights necessary to navigate the complexities of the market, ultimately leading to more informed and strategic trading decisions.