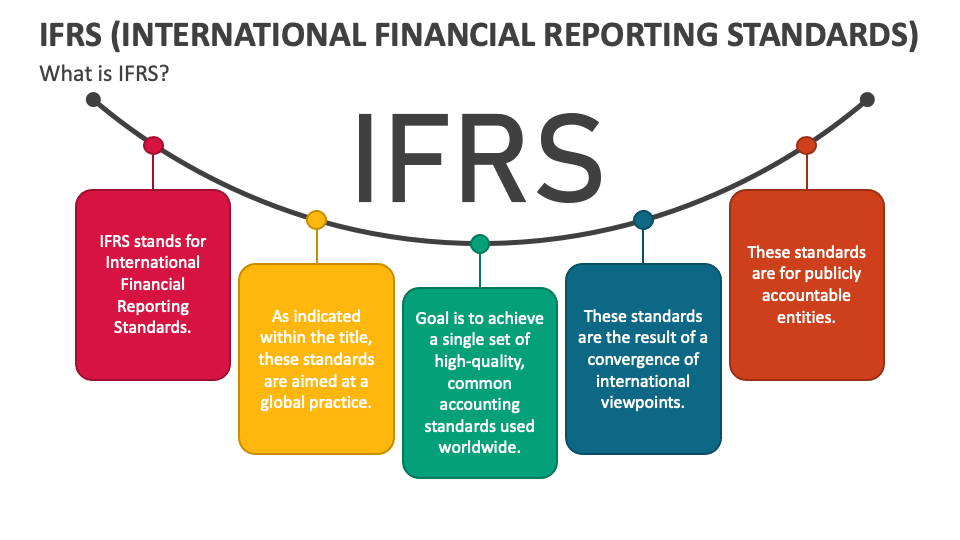

In cross-border merger and acquisition (M&A) transactions, the use of a common set of accounting standards, such as International Financial Reporting Standards (IFRS), offers several advantages that simplify the due diligence process and provide valuable insights into the target company’s position. Here’s how IFRS facilitates cross-border M&A:

Consistent Reporting

When both the acquiring company and the target company use IFRS for financial reporting, it ensures consistency in accounting policies, treatments, and presentation of financial information. This consistency allows the acquirer to easily compare and understand the data of the target company. Should you need some professional help to achieve your vision, FD Capital are a leading recruiter of FDs and CFOs in London.

Improved Comparability

IFRS fosters comparability of financial statements across different companies and industries. This comparability enables the acquirer to benchmark the target company’s financial performance against its peers, making it easier to evaluate the target’s relative position.

Simplified Financial Analysis

IFRS-compliant financial statements are designed to provide relevant and reliable information. During the due diligence process, the acquirer can conduct a more comprehensive and meaningful financial analysis, gaining insights into the target’s strengths, weaknesses, and potential risks.

Efficient Due Diligence

The use of a common accounting standard streamlines the due diligence process. The acquirer’s experts are more familiar with IFRS, which saves time and effort when reviewing the target company’s records and understanding its financial health.

Transparent Information:

IFRS emphasizes transparency and comprehensive disclosure of financial information. This transparency reduces information asymmetry between the acquirer and the target, making the transaction more trustworthy and reducing the risk of unexpected financial issues after the acquisition.

Easier Consolidation

After the acquisition, if the target company is to be consolidated into the acquirer’s financial statements, using IFRS ensures that the consolidation process is more straightforward. It reduces the need for extensive adjustments and conversions between different accounting frameworks.

International Reach

In cross-border M&A deals, IFRS is widely recognized and accepted in many jurisdictions globally. This recognition helps facilitate compliance with local regulations and accounting standards in various countries, which can be essential for post-acquisition integration.

By using a common language in financial reporting, IFRS simplifies the cross-border transaction process, reducing the risk of misunderstandings and errors. The consistent application of these standards across various regions promotes transparency and encourages international trade and investment.

Compliance with Regulatory Requirements

In some cases, regulatory authorities may require the use of IFRS for reporting in cross-border M&A transactions. Adhering to IFRS ensures compliance with these requirements, avoiding potential obstacles to regulatory approval.

Utilizing IFRS as a standardized framework fosters trust among regulators, increases the efficiency of the approval process, and helps companies meet the expectations of multiple jurisdictions. Ensuring alignment with IFRS not only facilitates the M&A process but also reflects a commitment to globally recognized best practices.

Final Thoughts

By adopting IFRS in cross-border M&A, companies can enhance the efficiency and reliability of the due diligence process, make more informed decisions, and increase the likelihood of a successful and smooth integration of the acquired business. This alignment with international standards streamlines operations and builds investor confidence. The global acceptance of IFRS underscores its critical role in modern finance and business strategies.